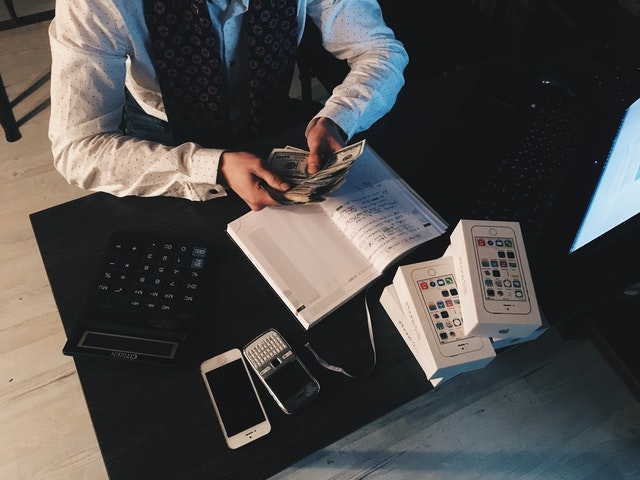

Maximize Your Financial Planning Success

While most of us would never go a year without performing annual maintenance on our homes or cars, neglecting annual reviews on our finances seems to be the norm.

That’s why we offer our clients Continuous Financial Planning. This service provides you continuous opportunity to hone your financial acumen, and to make proactive financial improvements that can set you up for maximum success.

A Lot Can Happen in a Year

A lot can happen in a year. You may have changed jobs. You may have received a raise. Benefit packages with your employer may have changed last year. What about taxes? Has the tax code changed since your last review?

Our opportunities change every year as well. While last year may not have allowed you to save as much as you would have wanted to, maybe this year brings a surplus of cash to your family’s bank account. Perhaps this is the year you contribute more to your Roth IRA (contribution limits changed in 2019) or your employee sponsored 401(k) (contribution limits changed in 2019).

After your Initial Financial Plan with Inspire in year one, you may be well positioned for continued financial planning success in year two and beyond.

Comprehensive Financial Planning

Inspire’s Continuous Financial Planning service starts with a comprehensive review of your financial plan beginning year two of your relationship with us. An Inspire annual review is not a portfolio review or a market update. It’s comprehensive in nature and typically involves exploration into the following areas:

- Retirement planning review to include social security, pension, part-time employment, IRA, business, and rental property income

- Income tax review which may include a review of previous years completed taxes

- Risk management to include personal insurance as well as employee benefits. Risk management is typically covered at a deeper level than in year one. Ancillary insurance protection like long-term care, disability income, life, umbrella, auto, and identity protection insurance are examined with renewed focus

- Risk tolerance analysis

- Portfolio performance annual review

- Portfolio strategy review

- Portfolio rebalancing & restructuring of employer sponsored plan

- Estate planning review

WHAT TO EXPECT

About a month before your second year with Inspire begins, we will mail you a hard copy invitation for your annual review, as well as several email reminders. Our goal is to engage you in the process of expanding on the success you should have made the previous year.

We will remind you what documents you need to bring for your review. Since we should still have a lot of the data from your Initial Financial Plan, there is less legwork on your part beginning year two.

While we do not recommend the same four to five meeting process as your Initial Financial Plan, we do recommend that our clients invest enough time for two to three meetings per year with their financial planner.

This allows you ample time to fully discuss new opportunities, obstacles, and changes that need to be explored.

Continuous Financial Planning Fees

Annual fees for our Continuous Financial Planning service run about one half of the amount of your Initial Financial Plan. Since we already have much of the data (mostly qualitative) needed from the year prior, it typically takes less time to conduct your annual review, therefore lowering the cost.